In today’s competitive business landscape, visibility is key. One of the most effective ways for businesses to establish an online presence and connect with potential customers is through their Google adding insurances to google business profile. Google Business Profiles allow companies to share essential information such as their address, phone number, operating hours, and services, ensuring they can be easily discovered by customers searching online. However, many businesses may not be aware that they can also add additional information, such as their insurance details, to enhance their profile.

In this article, we will explore why adding insurance information to your Google Business Profile is important, how to do it, and the benefits that come with ensuring your business appears trustworthy and professional.

Why Add Insurance Information to Your Google Business Profile?

While the primary function of a adding insurances to google business profile is to offer essential details like your location and contact info, it can also serve as a powerful tool for building trust with potential customers. Insurance information is one of the key details that some businesses may want to include, particularly in industries where insurance is an essential part of the service being offered, such as construction, healthcare, auto repair, and more.

There are several reasons why it may be advantageous to add your insurance information to your profile:

- Building Trust and Credibility: Displaying insurance details on your Google Business Profile can reassure potential clients that your business is legitimate and operates within the boundaries of the law. It demonstrates that you are committed to meeting industry standards and protecting both your customers and your business.

- Attracting Customers in Regulated Industries: For businesses in industries like construction, healthcare, and auto repair, having insurance is often a legal or regulatory requirement. By displaying your insurance information, you show potential clients that you meet industry standards and that they are protected when doing business with you.

- Meeting Client Expectations: Many clients expect businesses to be insured for liability reasons. For example, if you’re in home improvement or construction, customers want to know that if something goes wrong on their property, they’re covered. Similarly, healthcare providers need to show that they carry malpractice insurance to provide peace of mind to patients.

- Improving Customer Confidence: In some cases, potential customers may be hesitant to work with a business if they don’t see visible signs of professionalism, such as insurance. By providing this information, you create a more transparent business environment, which can help customers feel more confident in choosing your services.

How to Add Insurance Information to Your Google Business Profile

As of now, adding insurances to google business profile do not have a dedicated section for insurance information. However, there are several strategies you can use to ensure that your insurance details are visible to customers when they search for your business. Below are the steps to follow to add insurance information effectively to your profile:

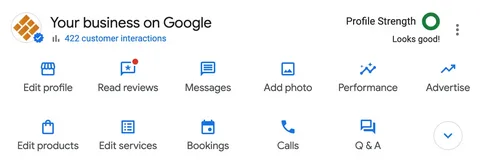

Step 1: Log in to Your Google Business Profile

Before you can make any updates to your profile, you need to log in to your Google Business Profile. Here’s how to do that:

- Go to Google Business Profile and click on “Manage Now.”

- Sign in using the Google account associated with your business.

- Select the business you want to update (if you manage multiple businesses).

Step 2: Add Insurance Information in the Business Description

While there is no direct “insurance” field in the adding insurances to google business profile dashboard, you can include insurance information in your business description. The business description is one of the first things customers see when they visit your profile, so it’s a great place to mention any relevant insurance coverage.

To update your business description:

- Click on the “Info” tab in your Google Business Profile dashboard.

- Scroll to the “Business Description” section.

- Edit your description to include relevant information about your insurance coverage. For example:

- “We are fully insured with general liability and worker’s compensation coverage to ensure the safety and security of our clients and employees.”

- “Our team carries professional malpractice insurance to provide peace of mind for all our patients.”

- Make sure the description remains concise, clear, and aligned with the other details of your business.

Step 3: Add Insurance Information to Your Services or Products

Another way to include insurance details is by adding them to the services or products section. For businesses that offer services that require insurance, such as auto repair or home remodeling, you can describe the type of coverage in the description of the service.

To add services:

- From the Google adding insurances to google business profile dashboard, go to the “Services” section.

- Click “Add Service” or “Edit” existing services.

- Add a new service or update an existing one with insurance details. For example, if you’re a contractor, you might add:

- “Home remodeling – Fully insured for general liability and property damage.”

- “Auto repair – Insured with coverage for all repair work.”

- Save your changes.

Step 4: Upload Insurance Certificates as Photos

If you want to go the extra mile, you can upload images of your insurance certificates as part of your adding insurances to google business profile photos. This can act as a form of verification and make it easier for customers to confirm that your business is fully insured.

To upload a photo:

- Go to the “Photos” section in the Google Business Profile dashboard.

- Click “Add Photos” and choose the file(s) you want to upload.

- Make sure that the image is clear and easy to read.

Note that Google might review the photos before they are published, so it may take a little time for them to appear on your profile.

Step 5: Respond to Questions and Reviews

Another way to share your insurance information is by responding to customer questions or reviews. If someone inquires about whether your business is insured, you can answer directly in the Q&A section of your adding insurances to google business profile. You can also address any concerns in your review responses.

To access the Q&A section:

- Go to your Google Business Profile dashboard.

- Click on “Q&A”.

- Add responses to questions regarding insurance or any other details you’d like to share.

Benefits of Adding Insurance Information to Your Google Business Profile

There are several key advantages to adding insurance details to your Google Business Profile:

- Increased Trust: Having insurance details available increases trust with potential clients who want to ensure their property or health is protected while working with you.

- Competitive Advantage: By showcasing your insurance coverage, you can stand out from competitors who may not provide this information upfront.

- Transparency: Being upfront about your coverage shows professionalism and transparency, which customers appreciate.

- Improved Local SEO: Google values complete adding insurances to google business profile. Adding detailed information about your insurance can contribute to an optimized profile, improving your visibility in local search results.

Conclusion

Adding insurance information to your adding insurances to google business profile is a smart and strategic move, particularly for businesses in industries where insurance is an essential aspect of the service. While Google doesn’t offer a specific field for this type of information, there are several ways you can incorporate it into your profile to enhance your credibility and build trust with potential clients. Whether through your business description, services, photos, or customer interactions, showcasing your insurance details demonstrates professionalism and helps ensure customers feel confident choosing your business. By taking these steps, you can strengthen your online presence and potentially boost your customer base.