Coin Stock: Navigating the Intersection of Digital Currency and Investment Opportunities

In recent years, the financial world has witnessed the rise of digital currencies, creating an ecosystem that stretches far beyond traditional banking. One facet of this revolution is coin stock—a niche market that represents both tangible and digital assets. Coin stock refers to shares or investments in companies and platforms that deal with cryptocurrencies, blockchain technology, and even collectible coins. This article explores the multifaceted world of coin stock, discussing its origins, market dynamics, investment potential, associated risks, and future outlook.

The Emergence of Coin Stock

The concept of coin stock has evolved alongside technological advancements and changing perceptions about money and assets. Historically, coins have served as a medium of exchange, a store of value, and symbols of national heritage. With the advent of blockchain technology, digital coins like Bitcoin and Ethereum have transformed how investors view and interact with currency.

Investors initially approached cryptocurrency as a speculative asset class, but over time, interest expanded to include companies that provide critical infrastructure for blockchain technologies. These companies, listed on various stock exchanges, have become the backbone of what is now commonly referred to as coin stock. They include mining firms, digital wallet providers, blockchain analytics companies, and fintech startups that facilitate crypto transactions.

This dual nature—encompassing both physical collectible coins and digital coins—has broadened the appeal of coin stock. As the market matures, investors are looking at not only the coins themselves but also the technological and financial systems that support them.

The Historical Context: From Traditional Coins to Digital Assets

Coins have a rich history that dates back thousands of years. Ancient civilizations used metal coins as a means to standardize trade, enforce economic policies, and display power. Over time, coins evolved into sophisticated instruments of national pride and economic stability. Central banks began issuing coins with the backing of precious metals, which gradually gave way to fiat currencies backed by government trust.

The digital age, however, introduced a paradigm shift. In 2009, Bitcoin emerged as the first decentralized digital currency. Created in the aftermath of the global financial crisis, Bitcoin promised an alternative to conventional banking, free from governmental oversight and traditional regulatory frameworks. Its success sparked a wave of innovation, leading to the creation of thousands of alternative cryptocurrencies and blockchain-based companies. This evolution led to the development of coin stock, where investors now purchase shares in companies that are driving this new financial revolution.

Market Dynamics and Investment Trends

Growth in Technology and Innovation

The explosion of blockchain technology has led to an increasing number of companies that are reshaping the financial industry. These companies have not only developed platforms for digital transactions but have also innovated in areas such as smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs). As a result, the coin stock market has seen a significant influx of venture capital and public investments.

Investment trends in coin stock are closely tied to technological advancements. For instance, as blockchain technology becomes more efficient and secure, companies that specialize in this domain often experience rapid growth. This growth is particularly attractive to investors who are keen on high-risk, high-reward opportunities. Moreover, regulatory developments in various countries have provided a clearer framework for these companies to operate, further boosting investor confidence.

Diversification in Investment Portfolios

Coin stock offers investors a unique opportunity to diversify their portfolios. Traditional investment assets like stocks and bonds are now complemented by a digital asset class that operates independently of conventional markets. This diversification can help reduce overall portfolio risk by balancing the volatility of cryptocurrency markets with the relative stability of coin stock investments in established companies.

Investors are increasingly viewing coin stock as a hedge against economic instability. With global financial markets prone to fluctuations due to geopolitical tensions, pandemics, or policy changes, having a stake in companies that operate on a decentralized and digital framework can be a strategic move. By combining exposure to both digital coins and the companies that support them, investors are creating a more resilient investment strategy that capitalizes on innovation while mitigating risk.

Regulatory Impact and Market Stability

Regulation plays a critical role in shaping the coin stock market. On one hand, regulatory clarity can provide a stable environment for companies to innovate and grow. On the other hand, sudden regulatory changes can introduce uncertainty, impacting stock prices and investor sentiment. Governments worldwide are grappling with how to regulate digital currencies and the companies that support them. In jurisdictions where clear guidelines have been established, coin stock markets tend to be more robust, attracting both institutional and retail investors.

Regulatory oversight has also led to the creation of new financial products. For example, exchange-traded funds (ETFs) that focus on blockchain technology and digital assets have become popular. These ETFs offer investors a way to gain exposure to coin stock without having to navigate the complexities of directly buying and storing cryptocurrencies. As a result, the regulatory environment continues to be a double-edged sword—presenting challenges while also opening up new opportunities for growth.

Investment Potential in Coin Stock

Technological Innovation and Market Expansion

The rapid pace of innovation in blockchain technology suggests that coin stock will remain an area of significant growth. Companies that pioneer solutions to longstanding problems in security, transparency, and efficiency are likely to attract substantial investments. For example, firms that develop robust cybersecurity measures for digital transactions or create user-friendly platforms for buying and selling cryptocurrencies are well-positioned to capitalize on market demand.

Investing in coin stock is not just about tapping into a trending technology; it is about recognizing the potential of a fundamental shift in how financial systems operate. As more businesses and consumers adopt digital currencies, the infrastructure supporting these transactions will become increasingly vital. Companies that lead in this space could see exponential growth, rewarding early investors with significant returns.

The Role of Institutional Investors

Institutional investors are increasingly entering the coin stock market, adding legitimacy and stability. These investors bring substantial capital and expertise, which can drive innovation and foster a more mature market environment. Their participation also signals a broader acceptance of coin stock as a viable investment asset. Institutions such as banks, hedge funds, and venture capital firms are now allocating portions of their portfolios to companies involved in digital currency and blockchain technology.

This institutional interest is critical for the coin stock market’s evolution. It encourages smaller investors to participate, knowing that large, well-established entities are confident in the market’s potential. Furthermore, institutional investments often lead to more rigorous due diligence and improved corporate governance, which benefits the overall health of the coin stock ecosystem.

Risk and Reward: Evaluating Coin Stock Investments

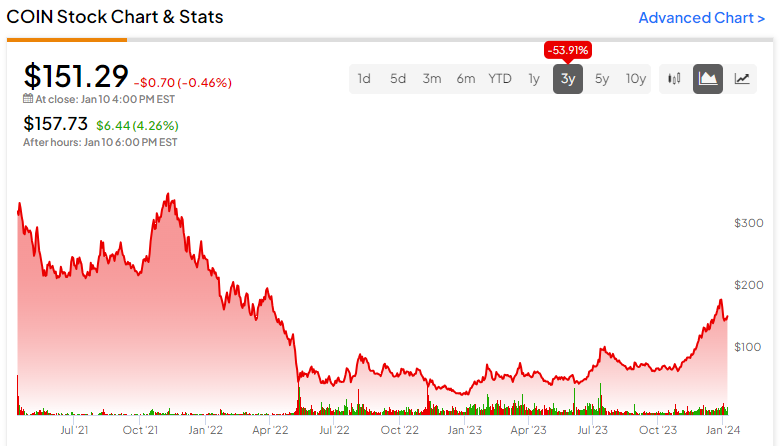

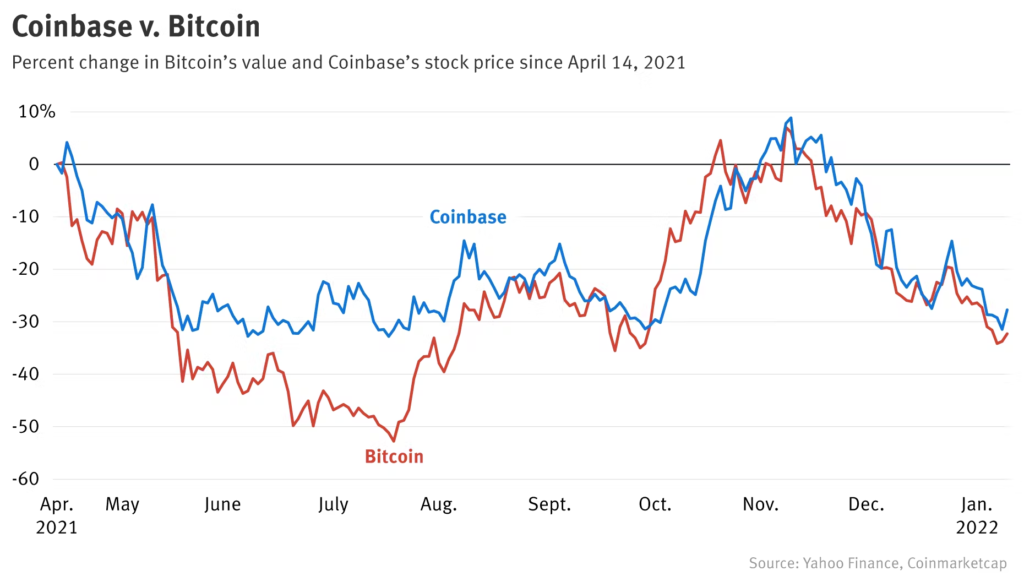

Investing in coin stock carries inherent risks, particularly due to market volatility and regulatory uncertainties. Digital currencies are known for their rapid price fluctuations, and companies operating in this space can be significantly affected by sudden market shifts. Additionally, the fast-evolving regulatory landscape means that companies may face unexpected hurdles that can impact their stock performance.

However, these risks are balanced by the potential for high rewards. Early investors in emerging technologies often reap substantial benefits if the companies they support become market leaders. Diversification strategies, such as investing in a mix of established companies and promising startups, can help mitigate risk while still offering exposure to significant upside potential.

Investors should also consider macroeconomic factors that influence the coin stock market. For instance, global economic uncertainty can lead to increased interest in alternative investments that are less correlated with traditional financial markets. Moreover, advancements in blockchain scalability, security, and interoperability are likely to drive sustained growth in the sector.

Key Factors Driving the Future of Coin Stock

Integration with Traditional Financial Systems

One of the most promising developments in the coin stock market is the increasing integration with traditional financial systems. Major banks and financial institutions are beginning to explore blockchain technology for various applications, from streamlining cross-border payments to enhancing the security of financial transactions. This integration is likely to create a bridge between the conventional financial sector and the digital asset space, encouraging further adoption of coin stock.

As traditional institutions invest in blockchain and cryptocurrency ventures, they bring with them established regulatory and compliance frameworks. This influx of expertise and oversight can lead to a more stable market environment, making coin stock an increasingly attractive investment option for a broader range of investors.

Technological Advancements and Innovation

The pace of technological innovation in the coin stock arena is relentless. Developments in areas such as quantum computing, artificial intelligence, and cybersecurity are set to redefine the capabilities of blockchain networks. These advancements can improve transaction speeds, enhance security, and reduce the environmental impact of digital mining, thereby boosting investor confidence.

Innovative business models are also emerging. Companies are exploring new ways to monetize blockchain technology, such as through decentralized finance platforms that offer financial services without traditional intermediaries. These models not only disrupt established financial practices but also provide investors with novel opportunities to participate in the digital economy.

Global Adoption and Market Expansion

Global adoption of digital currencies and blockchain technology is a key driver for the coin stock market. As more countries embrace these innovations, the market for coin stock is expected to expand significantly. Emerging markets, in particular, offer vast potential as populations in these regions increasingly access digital financial services. The democratization of finance—making banking and investment opportunities available to a broader demographic—could lead to unprecedented growth in the coin stock market.

The international scope of coin stock investments is also reflected in the diverse regulatory approaches seen around the world. While some countries have adopted a cautious stance, others are actively fostering innovation by creating favorable regulatory environments. This dynamic global landscape presents both challenges and opportunities for investors, who must remain agile and informed to navigate the complexities of international markets.

Strategies for Investing in Coin Stock

Research and Due Diligence

Successful investment in coin stock requires thorough research and due diligence. Investors should begin by understanding the fundamental technology behind blockchain and the specific business models of companies involved in this space. Analyzing market trends, regulatory news, and technological developments can provide valuable insights into which companies are likely to thrive.

Due diligence extends beyond financial performance. Investors should assess a company’s management team, competitive positioning, and strategic partnerships. Reading whitepapers, attending industry conferences, and following expert analyses can also help in making informed investment decisions. Staying abreast of regulatory changes is crucial, as these can significantly impact a company’s prospects.

Diversification and Risk Management

Given the inherent volatility of the coin stock market, diversification is a key strategy. Rather than concentrating investments in a single company or segment, investors should consider a broad portfolio that includes established industry leaders as well as promising startups. This diversified approach helps spread risk and increase the potential for steady returns.

Risk management strategies might also include setting stop-loss orders and regularly reviewing investment performance. In addition, investors should be prepared for market downturns by maintaining sufficient liquidity and avoiding over-leveraging. By combining these strategies with a long-term investment perspective, investors can better navigate the uncertainties of the coin stock market.

Embracing a Long-Term Perspective

Investing in coin stock is not typically a get-rich-quick scheme. Given the rapid pace of technological change and the evolving regulatory landscape, a long-term perspective is essential. Investors who are patient and willing to ride out periods of volatility are more likely to benefit from the underlying growth potential of blockchain technology and digital currencies.

A long-term view also allows investors to participate in the transformative trends that are reshaping the financial landscape. As coin stock companies continue to innovate and expand, those who hold on to their investments over the long haul may see significant rewards, despite short-term market fluctuations.

The Road Ahead: Challenges and Opportunities

Regulatory and Market Uncertainty

One of the most significant challenges facing the coin stock market is regulatory uncertainty. As governments and regulatory bodies strive to keep pace with rapid technological advancements, companies in this space may encounter shifting guidelines and compliance hurdles. This uncertainty can create short-term volatility, impacting investor sentiment and market stability.

Nevertheless, regulatory clarity is gradually emerging as authorities gain a better understanding of blockchain technology and digital currencies. In many regions, more comprehensive frameworks are being developed to balance innovation with investor protection. As these frameworks solidify, they are expected to enhance market stability and encourage further investment in coin stock.

Technological Hurdles and Competition

While the promise of blockchain technology is immense, several technological hurdles remain. Issues such as scalability, energy consumption, and interoperability between different blockchain networks are critical challenges that companies must overcome. Additionally, intense competition within the sector means that only those companies that continuously innovate and adapt are likely to succeed.

Investors need to be mindful of these challenges and recognize that the coin stock market is still in a nascent stage. The companies that manage to resolve these issues and position themselves as industry leaders will be best placed to capitalize on the long-term growth of the sector.

The Potential for Mainstream Adoption

Despite these challenges, the potential for mainstream adoption of digital currencies and blockchain technology remains high. As more people become familiar with and trust digital financial systems, the market for coin stock is likely to expand. Mainstream adoption could lead to increased consumer spending, improved financial inclusion, and a more resilient global financial system. This transformation is expected to drive further investments and create new opportunities for both individual and institutional investors.

Conclusion:

Coin stock represents a unique intersection of technology, finance, and innovation. It encapsulates the transition from traditional coins and banking systems to a new era defined by digital currencies and decentralized financial platforms. With roots in centuries-old coinage and the cutting-edge realm of blockchain, coin stock offers a compelling narrative of evolution, risk, and opportunity.

For investors, the allure of coin stock lies in its potential for substantial rewards, driven by rapid technological advancements and a growing global market. However, these opportunities come with their share of risks—ranging from regulatory uncertainty to technological challenges. Success in this arena requires thorough research, diversification, and a long-term perspective.

As the digital currency landscape continues to evolve, coin stock is likely to become an increasingly integral part of the broader financial ecosystem. Whether you are a seasoned investor or a newcomer looking to diversify your portfolio, understanding the dynamics of coin stock is essential. With a careful approach to risk management and an eye on emerging trends, investors can navigate this exciting, albeit volatile, market and potentially reap significant rewards.

In summary, coin stock is more than just a trend—it is a reflection of a fundamental shift in how we view money, technology, and value in the modern world. As we look to the future, the continued integration of digital currencies into everyday life, along with innovations in blockchain technology, promises to further transform the financial landscape. By staying informed and proactive, investors can harness the potential of coin stock and be part of a transformative journey toward a more inclusive and dynamic financial future.

This comprehensive exploration of coin stock underscores the importance of balancing ambition with caution. The rapid pace of innovation coupled with evolving regulatory environments creates a landscape that is both exciting and challenging. For those willing to invest the time to understand these dynamics, the rewards could be substantial—ushering in a new era of investment opportunities that bridge the gap between traditional finance and digital innovation.

Ultimately, the coin stock market stands as a testament to the power of technology in reshaping industries. It invites investors to rethink the fundamentals of currency, value, and economic growth. As we continue to witness the evolution of digital finance, coin stock is poised to remain at the forefront of this revolution, representing both a challenge and a remarkable opportunity for investors around the globe.

With careful planning, strategic investments, and a long-term perspective, the potential embedded in coin stock can be unlocked, providing a promising path forward in an increasingly digital world. Embracing the changes and innovations that define this sector will be key for those aiming to secure a place in the future of finance.